What is ZPER?

ZPER is a ‘decentralized P2P(peer-to-peer) financial ecosystem’ using smart contract technology. Top P2P lending companies and robo-advisors have coalesced to provide a revolutionary method of fund transactions between borrowers and lenders worldwide.

P2P Finance Alliance

Verified global P2P lending companies, information providers, and robo-advisors are part of the ZPER Alliance. The Alliance, which allows a variety of participants to freely interact and exchange values, provides a reasonable financial environment for borrowers and lenders.

All participants will be rewarded fairly for their contributions.

Midrate(CEO Seung-Hang Jake Lee) is a comprehensive P2P company and Korea P2P association president company. It is involved in various fields such as real estate and bond investment and boast of the best crisis management and technology in the industry.

Midrate’s default rate (delay of a portion or all of committed redemption passes 30 days or more and less than 90 days) is zero percent which present that it stays firmly in the tone of ‘Healthy Financial Linking Heart to Heart’. It’s cumulative loan amount is about 10.8 billion won. Midrate will participate in the ZPER ecosystem as a council to facilitate fund distribution.

FUNDA(CEO Sean Park) is a P2P company targeting small business owners and self-employed people. Utilizing Safe plan and Automatic Distributed Investment, it achieves 0% of investor loss ratio(investor repayment is overdue for more than 90 days from the normal redemption date). It’s cumulative loan amount is about 31.2 billion won and is regarded as a leader in personalized P2P loan sector.

Besides, it has attracted investment of 2.8 billion won from BC Card, becoming the first domestic P2P financial company to receive investment from large credit card companies. FUNDA will contribute to the development of a stable ecosystem as a council at ZPER.

Olley Funding (CEO JB Kim) is a P2P company aiming to provide practical help under the belief that “Together, Worthwhile Finance”. It is possible to secure both rationality and efficiency by suggesting the best type of funding for each user via customization technology. We are expecting for Olley to play a pivotal role as a council in ZPER since it is already cooperating with domestic companies who have the best Big data and Machine Learning technology.

Together Funding (CEO Hang-Joo Kim) is currently the largest and NO.1 company in the real estate-mortgage-secured P2P financial sector (based on Korea P2P Financial Association data) with a cumulative loan of about 120 billion won. Because it is secured mortgage loan investment (basic asset: real estate), it can guarantee both expected return and investment stability.

JB Financing holding takes charge of deposit management and DaeShin Saving Bank and Lotte Insurance joined Together Funding as partners to further enhance its expertise

Popfunding is the first among Korean lending company to have launched small-amount loan services on its system in 2008, after entering into a business partnership with Jeil savings bank in May 2007. Popfunding has been continuously emphasizing to investors about the significance of understanding borrowers and lending markets, constantly contemplating in many ways to manage surplus funds more efficiently and connect them relevantly to those more ungently in need.

The team’s aim is to contribute in the process of creating happier world in which everyone feels rich.Popfunding’s fundraising amount adds up to 8billion USD. They were rewarded as the ‘2017 best P2P lender’. Their achievement presented new path for Korean P2P lending markets towards cross-border transactions such as those by investors interested in international businesses & bodies or the flow of overseas venture capitals.

Mouda is the Korea’s very first specialized P2P lending platform who provides high quality and credible investment products in the field of medicine. Experts in each field of the medical industry, data analysis, finance, and the legal matters came together to provide investment products of the best quality. They are known for constructing products best fit for doctors and other medical practitioners interested in investment.

LoanPoint is a crowdfunding platform dealing with real estate assets, which guarantees safe, low-risk investment for personal investors who have little knowledge on real estates. Actual developers or real estate professionals upload crowdfunding projects and those that pass strict assessment will be confirmed for fundraising. Only verified assets are accepted here, such as NPL purchase capitals and top-tier real estates. For minimized risks and principal losses, the team works in strategic partnerships with many professional businesses in the field.

Zoomfund, also known as The Zoom Fund Management, is a P2P lending company associated with KTB Network and is entirely supported with the investment of KTB Credit Information, the company in charge of bond management and collection of the Korean Asset Management Corporation (KAMCO) and the Korean Deposit Inssurance Corporation (KDIC). Their specialty is in their use of a model based on the big data of the borrowers’ financial and non-financial transaction information. They put forward average profit rate of 12.7%, delinquency rate and default rate of 0%.

Main-sale starting at

16th Apr. 05:00 UTC

ZPER Token(ZPR)

Distribution

Issuance term

Distribution

Issuance term

ICO Volume

2,200,000,000ZPR

Token Sale

1,100,000,000ZPR

Hardcap

48,000ETH

Softcap

5,000ETH

Currency Accepted

ETH

2,200,000,000ZPR

Token Sale

1,100,000,000ZPR

Hardcap

48,000ETH

Softcap

5,000ETH

Currency Accepted

ETH

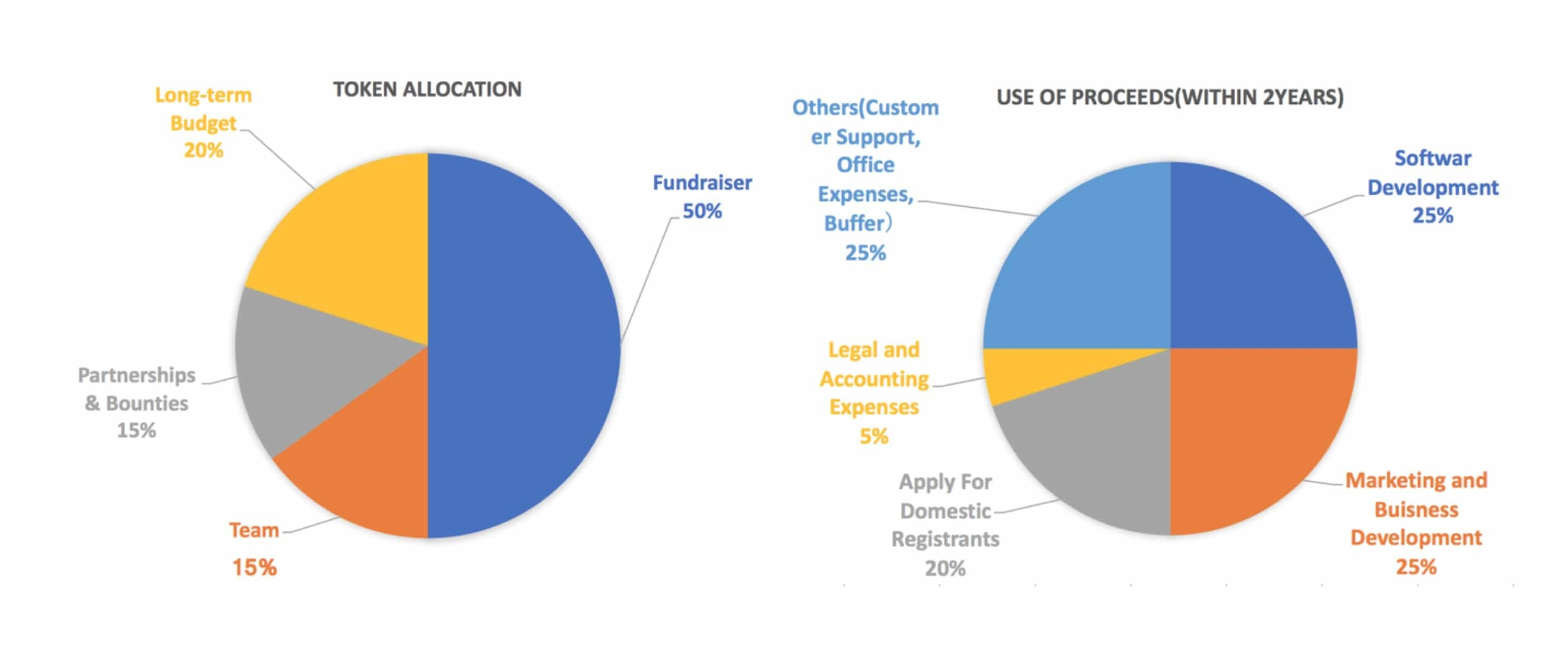

Token Allocation

Token Sale

50%

Ecosystem

22.3%

Team & Advisors

17%

Reserve

10.7%

50%

Ecosystem

22.3%

Team & Advisors

17%

Reserve

10.7%

For more information, visit the link below:

Website: https://zper.io/

White paper: https://zper.io/paper/Whitepaper_Eng.pdf

Twitter: https://twitter.com/zper_team

Facebook: https://www.facebook.com/ZPERplatform/

Media: https://medium.com/@zper

Telegram: https://t.me/zper_kr_official

No comments:

Post a Comment